“I am excited about the huge potential for Prosus – our journey to the next US$100 billion of value is well under way.” – Fabricio Bloisi, Group CEO

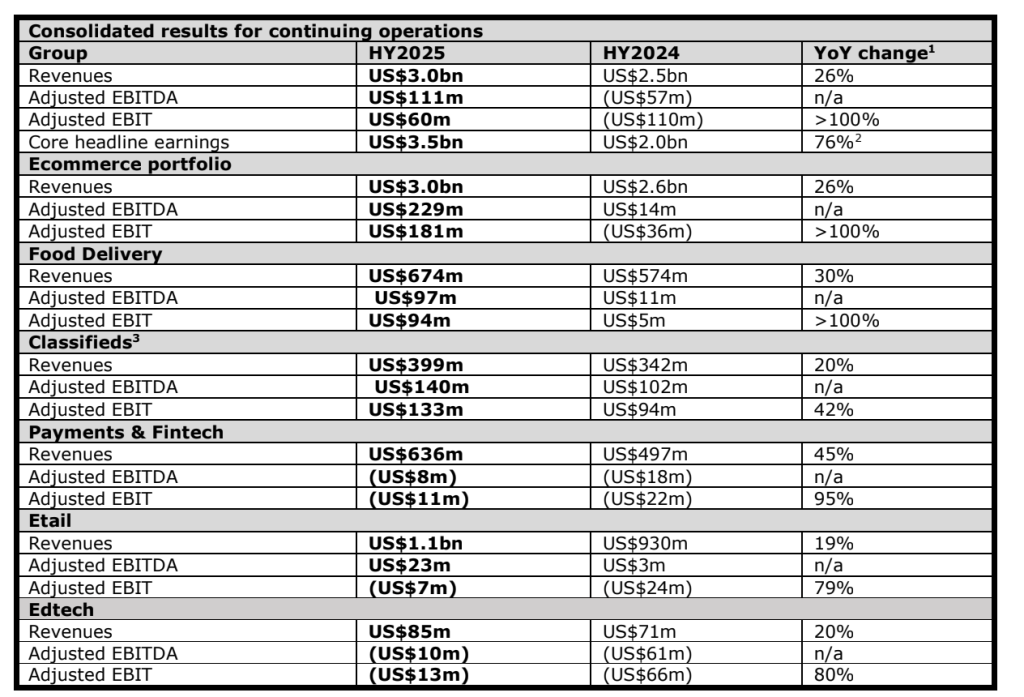

The first six months of the financial year have been a successful period for the Group. Our operations delivered topline growth of 26%, with consolidated Ecommerce revenue of US$3.0bn, and we increased Ecommerce adjusted EBIT by five times to US$181m. We recently celebrated the listing of Swiggy, valued at US$11.3bn, and sold US$2bn+ of assets, including a portion of our Swiggy stake and our Trip.com position.

Our buyback has created US$36bn of value since launch, with 10% NAV per share accretion, and is the largest globally of any tech company as a portion of market capitalisation. We are actively exploring the immense AI opportunity for our more than 2 billion customers, to accelerate our growth and profitability, and we are confident in the impact and value it will bring.

Fabricio Bloisi, Group CEO, said: “Innovation and reinvention are in our DNA and essential to our success. We are embracing the massive opportunity we see in deploying AI to deliver exceptional products and services to our 2 billion customers. Our future growth will be driven by our AI-first mindset and disciplined investment into building world-class marketplaces, combined with greater collaboration across the ecosystem and our ability to build a winning culture. We are already showing signs of success, with peer-leading growth and rising profitability across our Ecommerce portfolio.

“AI is transforming the way we work and how we serve our customers. We have data from billions of transactions across our portfolio that allow us to train AI models to personalise the customer experience and better predict their needs. This is a competitive advantage for our technology ecosystem. I am excited about the huge potential for Prosus – our journey to the next US$100 billion of value is well under way.”

Ervin Tu, President and CIO, Prosus and Naspers, commented: “In the past six months, we’ve made substantial progress delivering on our strategy. Our Group is profitable after corporate costs, and our ongoing share buyback programme continues to create meaningful shareholder value. With Swiggy’s recent IPO, and by actively managing our portfolio through equity stake sales, we’ve highlighted significant pools of value and we’re confident there’s even more ahead. With our strong and liquid balance sheet, we plan to grow and leverage our ecosystem, with an eye on the next wave of opportunity. “We believe the combination of stronger-performing operating businesses, value creating M&A, and our open-ended share-repurchase programme will continue to drive shareholder returns.”

Directorate change

After 29 years of exemplary leadership and service, Basil Sgourdos will retire as Group Chief Financial Officer, effective 30 November 2024. Nico Marais will assume the role of Interim Chief Financial Officer of Naspers and Prosus. The process to finalise the role of the Group Chief Financial Officer has begun and the market will be advised of this decision in due course.

The board of directors has decided to nominate Mrs Phuthi Mahanyele-Dabengwa for appointment as an executive director of Prosus at the next annual general meeting. Mrs Mahanyele-Dabengwa is currently the Chief Executive Officer of Naspers South Africa. She is also an independent nonexecutive director of Vodacom and Discovery Insure. She is a member of the United Nations Global Compact SA board and of the BRICS council.

With effect from 1 April 2025, Mrs Mahanyele-Dabengwa is expected to be appointed as an executive director of Naspers Limited.

Group performance

Peer-leading growth and accelerating profitability across Ecommerce portfolio

Food Delivery – iFood reaches 100m order milestone⁴, achieves record profit and drives innovation and ecosystem expansion, and Swiggy’s IPO delivers gain of US$2bn

- iFood delivered strong top line growth, with Gross Merchandise Value (GMV) up32%, orders up 29% and revenue increasing 30%.

- iFood’s core restaurant business grew aEBIT by 85% to US$148m, improving aEBIT margin to 26%.

- Extensions grew revenue by 30%, driven by strong performance in groceries marketplace and credit businesses

- Overall, iFood achieved a record profit, with aEBIT of US$98m, up 387%.

- Delivery Hero grew GMV by 6% for the six months ended 30 June 2024, with revenue up 19%, boosting profitability to an adjusted EBITDA of €241m (up from €9m in 1H23).

- Swiggy grew Gross Order Value (GOV) by 24%, while adjusted EBITDA losses reduced to US$85m.

- Swiggy listed on Indian exchanges in November, with a valuation of US$11.3bn, and a Prosus gain of US$2bn on total investment.

1 All growth percentages shown here are in local currency terms, excluding the impact of acquisitions and disposals (M&A), unless otherwise stated.

2 Nominal basis

3 Excludes OLX Autos and OLX Autos financing business

4 iFood reported more than 100m orders in August 2024

Classifieds – OLX Group: Strong performance, with continued growth and expanding margins

- Classifieds consolidated revenue grew 20%, with standout performances by motors and real estate verticals.

- Motors and real estate verticals grew revenue 26% and 27% respectively, reflecting new pricing strategies, improved monetisation and higher adoption of value-added services.

- aEBIT increased by 42% to US$133m, with aEBIT margin up 6pp, to 33%.

Payments & Fintech – PayU: Strong overall performance, with significant revenue growth and improving margins

- Consolidated revenue grew 45% to US$636m, with significant contributions from Iyzico, GPO and Indian credit.

- Indian payments Total Payment Volume (TPV) increased by 27%, and revenues by 14%, while aEBIT loss of US$12m reflected lower take rates.

- Indian credit grew its loan book by 63%, revenues by 93% and improved its aEBIT margin by 12pp, delivering an aEBIT loss of US$12m.

- Iyzico grew revenues 151% to US$120m, while aEBIT of US$7m was impacted by lower gross margins and higher costs.

- GPO revenues up 32% to US$175m, with aEBIT of US$12m; sale of GPO ongoing,with completion due in FY25.

- Overall, aEBIT losses improved by 95% to US$11m, reflecting continued

- investment in PayU India.

Etail: Improving sales trajectory, with eMAG on track for overall profitability for FY25

- Strong growth with GMV up 16%, and revenue up 19% to US$1.1bn.

- aEBIT improved by US$15m to a loss of US$7m; includes US$10m restructuring costs in Hungary

- Improved performance due to cost optimisations, better marketing execution

Edtech: Improving performance, with a focus on profitability

- Consolidated revenue grew 20% to US$85m, while trading losses reduced byUS$53m to a loss of US$13m.

- Stack Overflow revenues up 21% to $57m and aEBIT loss narrowed to US$7m,driven by new API offer.

- GoodHabitz grew revenue by 17%, with an aEBIT loss of US$2m.

Please note: Group results are shown on a consolidated basis from continuing operations, which reflect all majority owned and managed businesses. All OLX Autos business units are classified as discontinued operations, in line with IFRS disclosures. All growth percentages shown here are in local currency terms, excluding the impact of acquisitions and disposals (M&A), unless otherwise stated. Growth percentages shown here for all non-financial key performance indicators compare HY25 to HY24.

For full details of the Group’s results, please visit www.prosus.com

“I am excited about the huge potential for Prosus – our journey to the next US$100 billion of value is well under way.” – Fabricio Bloisi, Group CEO