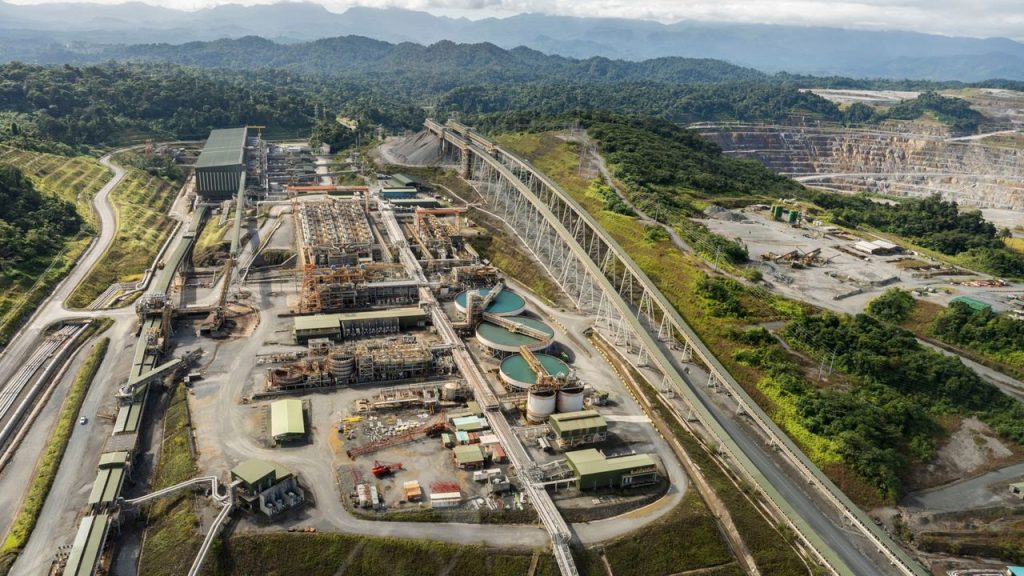

Panama and Canada have been negotiating on a copper mine that could have profound implications for the global resources market. The Cobre Panama mine, which is operated by Canadian mining company First Quantum, has been closed since 2023 following a ruling by Panama’s Supreme Court. While First Quantum seems open to allowing some operations to resume, the site remains controversial within Panama.

The plan

Panamanian President José Raúl Mulino said that he will announce his decision about whether to reopen the Cobre Panama mine by June. The country had “halted operations” at the mine because its “government concession was deemed unconstitutional,” said The Independent. The closure also came amid protests by environmental groups.

The original decision to shutter the mine weighed heavily on Panama’s economy, as it “accounted for nearly 5% of Panama’s gross domestic product the last year it operated,” said The Independent. Regardless of what happens next, First Quantum has welcomed a plan to “allow the removal and processing of stockpiled ore” at the site, said Reuters.

This plan, announced by Mulino, would help “mitigate the environmental and operational risks” associated with running the mine, said Reuters. But officials have also made it clear that the processing of stockpiles is “not a reopening of the mine,” First Quantum said in a statement. A decision on that end will be made later this year; the possibility has “become one of the biggest uncertainties in the global copper market,” said Bloomberg.

Restarting the mine ‘would provide a significant lift’

Given the contentious circumstances of the mine’s closure, Panama now “faces a delicate balancing act” in the region, said Bloomberg. But Panama could also be receiving some assistance from a neighbor to the south; Chilean President-elect José Antonio Kast has offered to help with the mine, which “could lend credibility given Chile’s status as the world’s largest copper producer.” Kast has also been working in his own country to consolidate Chile’s mining industry before he takes office.

If Panama were to make the choice to fully reopen the Cobre Panama mine, it “would provide a significant lift to Panama’s economy and to First Quantum,” said Bloomberg. This could also help give a boost to the copper economy, as the operation is set to “account for nearly 2% of global supply.” Continuing negotiations between Panama and Canada are “pending the outcome of an audit assessing the condition of the facilities and environmental risks.”

In the meantime, First Quantum will be surging ahead with its copper production. Across its other mines, the company expects to harvest 413,000 to 479,000 tons of copper in 2026, 451,000 to 518,000 tons in 2027, and 473,000 to 540,000 tons in 2028, according to First Quantum’s metrics. These numbers have been slightly downgraded by the company from prior figures, but the copper market “may take some comfort in the likelihood that the miner could begin processing stockpiled ore at Cobre Panama in the coming months,” Matt Murphy, an analyst at BMO Metals, said to industry outlet mining.com.

Panama is set to make a final decision on the mine this summer