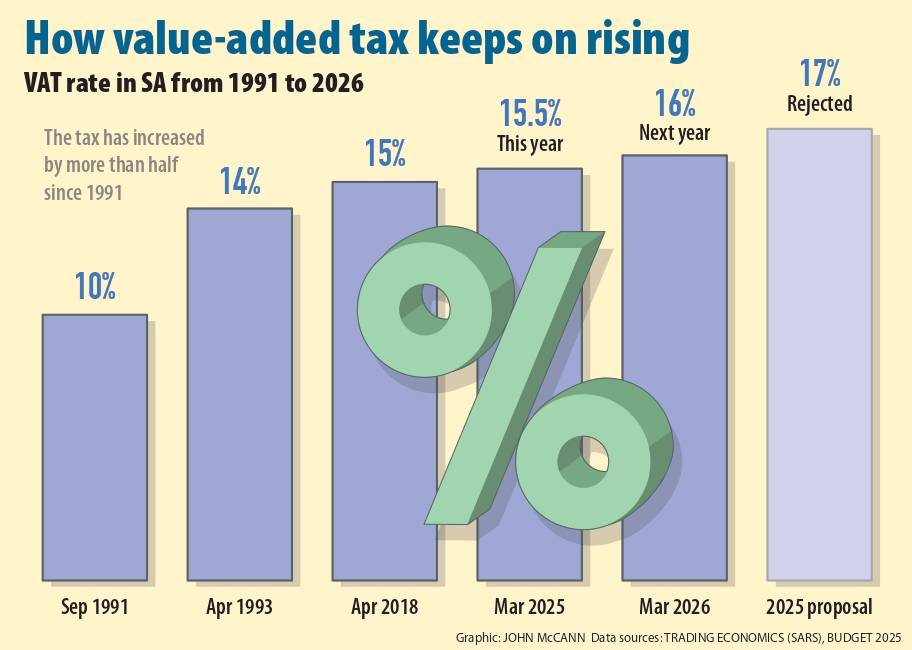

The coalition battle over taxes will move from the political shadows to parliament’s finance committees after Finance Minister Enoch Godongwana insisted on increasing VAT, although he halved his initial proposal of a two percentage point hike.

When he delivered it to parliament on Wednesday, Godongwana announced staggered 0.5 percentage point increases in 2025-26 and the following financial year, which will bring the VAT rate to 16% by 2026-27, and pull in expected additional revenue of R13.5 billion and R14.3 billion, respectively.

In the budget he was forced to abandon at the last moment last month, Godongwana had hoped to cover a R60 billion revenue shortfall for education, health, transport and security through higher VAT.

To help make up the difference, he is clawing back R19.5 billion through fiscal drag by reversing his decision last month to adjust personal income tax brackets and medical tax credits for inflation.

These will now remain as is for the second year in a row.

The tax measures were swiftly rejected by the Democratic Alliance (DA), which accused Godongwana of sacrificing the poor and hurting the country’s growth prospects.

“The ANC’s VAT budget does not have a majority and the DA has made it very clear that, if it wants us to support a budget, it needs to be based on growth and jobs.

“We remain open to discussions on how we can make that happen, and for compromises to be made, but it is now up to the ANC to get on top of the mess that it has created,” DA leader John Steenhuisen said.

He said 10 months into coalition rule, the ANC had not reckoned with its new political reality but behaved as though it still commanded a parliamentary majority.

“As a consequence, the people of South Africa will be poorer and the future of the government is at risk,” Steenhuisen said, repeating a threat voiced in recent red-line battles over policy and legislation.

In his speech to the National Assembly on Wednesday, Godongwana conceded that nobody would escape the effect of the VAT increases, despite plans to expand zero-rating on food, and that lower taxes could have spurred an economy that grew by just 0.6% last year.

“VAT is a tax that affects everyone. By opting for a marginal increase to VAT, its distributional effect and impact were cautiously considered,” he said.

“No minister of finance is ever happy to raise taxes. We are aware of the fact that a lower overall burden of tax can help to increase investment and job creation and also unlock household spending power.”

But, at a media briefing prior to the speech, he claimed that, in consultations on the budget, DA leaders had conceded that the party needed a political victory after failing to force the ANC to rethink the Basic Education Amendment Laws Act and the Expropriation Act.

“It is not about the VAT increase, it is about a whole lot of grievances they have. Therefore, they want to win something. It is important that we call a spade a spade.”

The VAT increment is set to take effect on 1 May but must first be passed into law by parliament.

Godongwana managed to unite his own party behind a lower increase after a couple of its ministers objected to his initial proposal.

But he acknowledged that coalition partners would push for an amendment in coming weeks, starting on Friday, when the standing and select committees on finance meet.

He had done what he could to resolve the impasse while meeting spending pressures and staying close to the treasury’s debt consolidation target, the minister added.

“Today I table and walk away.”

His effort received a lukewarm response from economists, who pointed to a level of fiscal slippage, the perennial growth problem and the possibility that the budget might not be approved by parliament without the support of the DA.

In terms of the Money Bills Amendment Procedure and Related Matters Act, the finance committees have 16 days, from the tabling of the budget, to report to the National Assembly and the National Council of Provinces whether they accept or reject the minister’s revenue proposals.

The reports must be considered by the chambers within that same time frame.

The Act sets out guidelines for amending the fiscal framework or any money bill, mandating the legislature to ensure that there is “an appropriate balance between revenue, expenditure and borrowing”.

In addition, they must consider economic growth potential, ensure debt levels remain reasonable and allow for adequate spending on infrastructure.

The ANC will argue, as Godongwana has done, that the reworked budget he presented this week seeks to carefully balance these objectives.

It sees the treasury stay the course towards higher primary surpluses and fiscal consolidation with gross loan debt now expected to stabilise at 76.2% of GDP in 2025-26. That is almost one percentage point higher than forecast last year, and 0.1 percentage points above the forecast in last month’s draft — a function of the reduced VAT increase.

The primary surplus will increase to 0.9% in 2025-26 from 0.5% and the consolidated deficit is projected to narrow from 5% in the current year to 3.5% in 2027-28.

Debt service costs will stabilise at 21.7% of revenue, or R389.3 billion.

It exceeded what the state spent on health, schooling and policing, Godongwana stressed, and consumed revenue that could be invested in infrastructure and growing the stagnant economy.

He has added additional R46.7 billion to more than R1 trillion for public infrastructure spending over three years, with a focus on energy, transport and water projects.

The treasury expects GDP growth of an average 1.8% over the medium term, more than double the current rate, but well below levels that would allow adequate developmental spending.

Instead, fiscal space remains so restricted that Godongwana has maintained that without tax increases, the country would have to make do with fewer teachers and health workers.

According to the budget review, the health and education budgets will grow by an average 5.9% a year in the medium term, and welfare grants will increase by 5.3%, in part to mitigate the effect of the VAT hike.

Labour federation Cosatu maintained that tax increases were unnecessary and called the budget an “extreme disappointment” and a blow to working-class families and an already battered economy.

The minister’s critics in the coalition agree, saying his refusal to depart from the easy route to more revenue, and compromise offer of a lower increase, made days after last month’s debacle, was hubris.

However, the DA’s fraught messaging increasingly suggests less of a fight to spare South Africans more taxes than to assert itself in the coalition and prove that it can influence government policy.

On Wednesday, Steenhuisen confirmed that the party would be prepared to accept tax increases, provided the ANC agreed to a range of demands for economic reforms not directly related to the budget.

“We have made it very clear to the ANC in the GNU [government of national unity] that we would not support any increases in taxes unless those increases were temporary and the ANC agreed to a series of major reforms that would grow the economy, produce jobs, reduce waste and bring down taxes within three years,” he said.

This translated, more than one MP said, into telling voters they should accept paying higher taxes in return for the promise of reforms and did not send a winning message ahead of next year’s local government elections.

Budget approval hangs in the balance and resistance to it is set to play out in the legislature’s finance committees